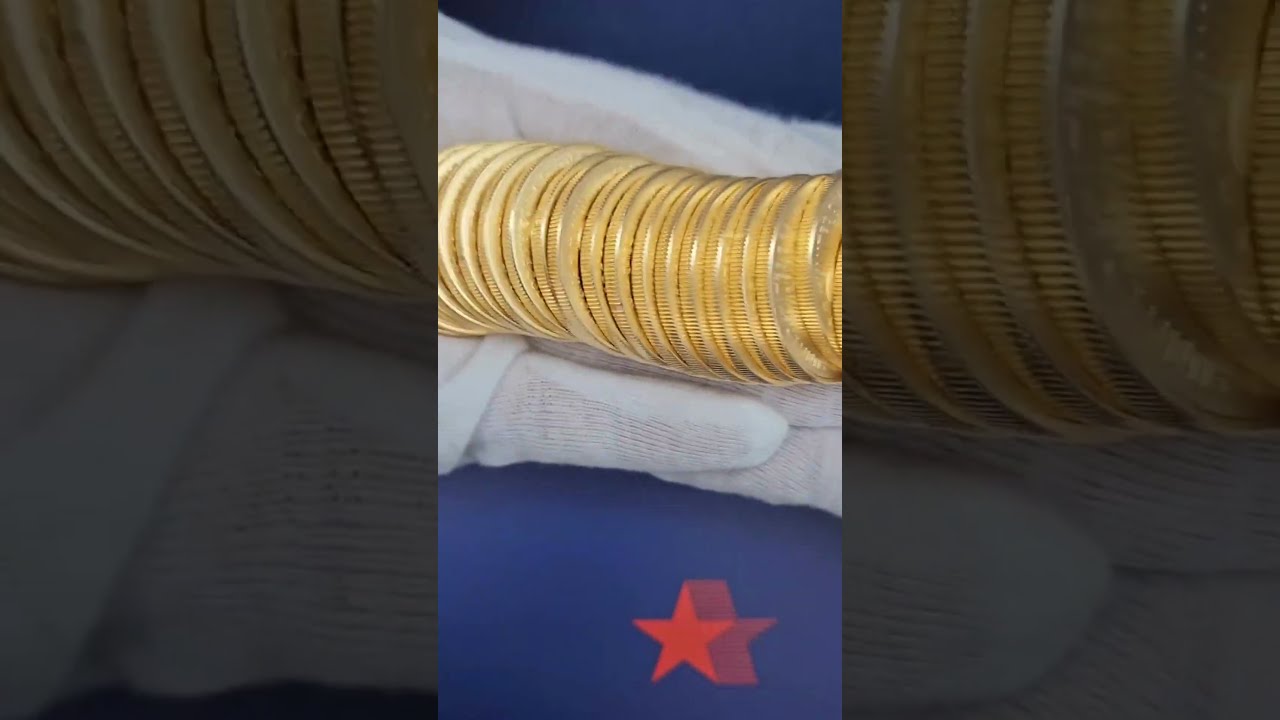

A Gold IRA offers an alternative for retired life profile diversity and financial uncertainty protection through tax obligation advantages and long-lasting growth opportunities. The distinct financial investment choice enables you to keep physical gold and precious metals inside your retirement plan which delivers protection and possibilities for extended development. This discussion will discuss the concept of a Gold IRA and explore its benefits such as asset preservation and inflation security while examining possible risks and laying out the steps called for to set one up. Strategic property allotment jointly with a tactical investment perspective makes sure wide range security while gold financial investments use potential economic development opportunities. A Gold IRA allows you to purchase physical precious metals such as gold bullion and coins within a retirement account that complies with IRS guidelines to supply tax-deferred benefits.

Definition and Explanation

With a Gold IRA you can keep physical gold and additional precious metals in your pension which creates an one-of-a-kind method of conserving for retirement while protecting your capital value. A self-directed IRA uses retirement profile diversity in addition to wealth growth opportunities through physical properties that maintain their worth throughout market changes. Precious metals keep their worth during financial instability and inflationary periods which shields your retirement savings. The alternative retired life method accomplishes financial security with diversification and builds self-confidence among financiers focused on securing their future finances.Benefits of Investing in a Gold IRA

A Gold IRA provides a number of advantages that include securing versus inflation while improving financial protection and offering feasible tax obligation advantages along with security versus financial instability. People who intend to secure their retirement savings while pursuing long-term investment growth ought to consider this approach. These qualities improve your profile's capability to stand up to financial slumps in addition to fluctuations in market conditions and interest rate changes.Protection Against Rising cost of living and Financial Uncertainty

A Gold IRA works as an effective rising cost of living guard to aid preserve financial investment security throughout economic unpredictability and gold cost variations. Concrete properties like gold assistance preserve monetary stability and safeguard retired life funds due to the fact that they hold value through unpredictable market durations. Substantial possessions like gold normally increase in worth throughout rising cost of living durations which decrease fiat money acquiring power and therefore work as dependable protection against inflation.Potential Risks of a Gold IRA

Gold IRAs deliver useful benefits yet present possible threats which need your attention including liquidity hurdles and market exposure alongside financial investment dangers.Liquidity and Market Fluctuations

The ability to accessibility funds can be significantly affected by market changes and rate volatility in the gold market when investing in a Gold IRA since liquidity remains an essential consideration. You need to carry out a detailed testimonial of your investment strategy to stay prepared for sudden shifts in the gold market while accomplishing your financial investment targets. When economic problems become unpredictable or markets decline, gold demand has a tendency to boost which leads to greater rates and longer purchase durations along with raised costs. Marketing gold premiums alter considerably which makes your financial investment landscape challenging to navigate while highlighting why proper investment research is vital.How to Invest in a Gold IRA

The facility of a Gold IRA account needs calculated preparation to create the account correctly and choose an appropriate custodian while making experienced financial investment selections in precious metals and various other asset kinds.Steps to Establishing an Account

The setup of a Gold IRA needs multiple essential steps to follow IRS requirements and simultaneously provides a method to take care of retired life possessions and far better take care of wealth. Finishing the called for paperwork and moneying your brand-new account via both payments and rollovers from existing retirement accounts is essential alongside comprehending IRA contribution limits. You will proceed with finishing several kinds, including a consumer information type and a transfer ask for funds from an additional account in addition to files confirming your Gold IRA qualification in accordance with standard individual retirement account regulations. Strict adherence to IRS conformity demands secures your investments from risks and fines while playing a key role in attaining your retired life preparing objectives.Choosing a Custodian and Selecting Gold Investments

The choice of a trustworthy custodian for your Gold IRA is crucial since they will certainly manage your account administration and financial investment assistance while supplying estate preparation assistance for your retired life funds. Picking a custodian demands careful evaluation of their charges structure, track record, experience with rare-earth element investments and their knowledge of the international economic situation and gold market patterns. Multiple kinds of gold financial investments come to be necessary components of your financial investment method that develop development and security possibilities while sustaining your retired life revenue. Gold mining supplies supply investors with a special risk-return equilibrium while offering the opportunity of greater returns which aid diversify investment alternatives.Is a gold IRA an excellent investment?

Investors seeking to secure their retirement savings from market swings while expanding their profile can gain from the tax obligation ramifications and investment capacity of gold IRAs.What is a gold IRA?

A gold IRA operates as a financial investment approach where investors save physical gold within a custodian account to facilitate lasting development potential. Buying a gold IRA gives several benefits to financiers. A gold IRA gives security against inflation and economic slumps while serving as a trustworthy wealth preservation tool that aligns with a long-term investment strategy. A gold IRA offers profile diversification and the possibility for higher returns past conventional IRA investments while making it possible for complete investment analysis. What prospective risks exist when buying a gold IRA? A gold IRA carries investment threats which require capitalists to perform thorough research and analyze potential risks prior to spending. Gold worths alter over time, fees exist for buying and storing gold bullion, and supply and need estimates have to be assessed. Before deciding on an investment one needs to execute research and examine market problems together with possible investment risks. What actions must I https://techbullion.com/nhttps://www.instapaper.com/read/1749973207avigating-economic-uncertainty-top-5-best-gold-ira-companies-in-2023/ comply with to establish a gold IRA? To establish a gold IRA you need to choose a trustworthy custodian that will certainly supervise the acquiring and keeping of physical gold properties including gold bullion or gold coins. You can move money from your existing pension to your brand-new gold IRA and then identify which sort of gold to purchase by examining gold costs and market problems. Does a gold IRA function as an ideal choice for each and every individual? A gold IRA investment might not suit every individual. Prospective investors need to seek advice from an economic consultant and analyze their monetary goals together with their individual scenarios before selecting any type of investment choices. An analysis of tax obligation impacts along with liquidity and the long-term growth leads ought to be performed prior to investing in precious metals and alternate financial investments within your retirement portfolio.